SILVER is making a big move. Has the paper market manipulation finally failed? What does it mean? Greater industrial demand? Meanwhile, 90% "junk silver" coins are being sent to the smelters as collectors sell it off en masse to take a profit. It's a very confusing picture.

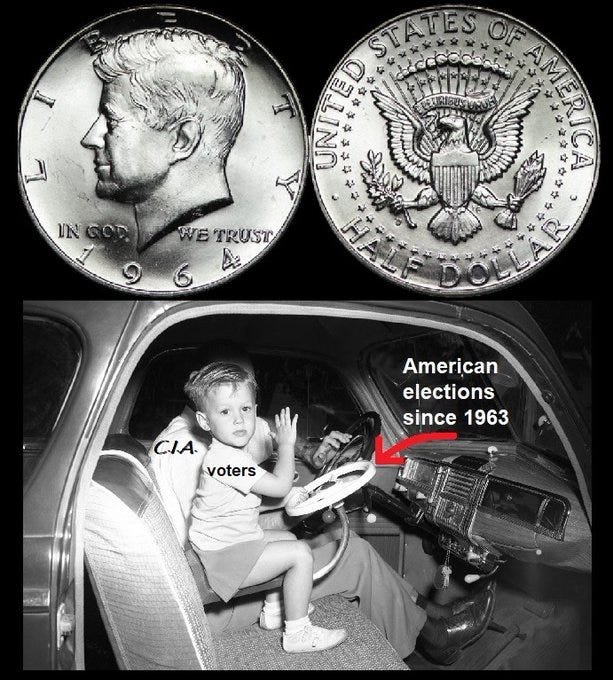

Incidentally, JFK was murdered by our own government intel agencies [or so it now appears] in 1963, and in 1964, millions of 90% silver Kennedy half dollars were minted in his memory. Then in 1965, American coinage was switched from silver to copper with only silver painted sides. A sign of times.

Jesse Colombo, who writes The Bubble Report on Substack, put this column out in the open, instead of behind his usual paywall. Here's a screen capture of the top, you can read the rest at his Substack link.

This coin dealer in Florida does weekly updates on the retail over-the-counter precious metals trade. It's an interesting real-world view to compare to all the commodities writers out there who are often trying to push positions. "Vermillion Enterprises" is their YouTube channel. This is their show from Monday July 14.

Currently, they are buying junk 90% silver at $2 below spot price, and selling it at $1 below spot price. If "the value of a thing is the price it will bring," what does this mean if the price of silver is climbing, but junk 90 is selling for below spot? Greater industrial demand than collector-prepper-stacker demand?

I just updated my silver coins / minimum wage meme using this very useful precious metals website: http://coinapps.com/silver/coin/calculator/ The federal minimum wage has gone up from $1.25 / hour in 1964, to $7.25 / hour in 2025.

Today do American feel richer, or poorer, in their real purchasing power? Today, the melt value of one pre-1965 silver quarter is $7, just below the current minimum wage.

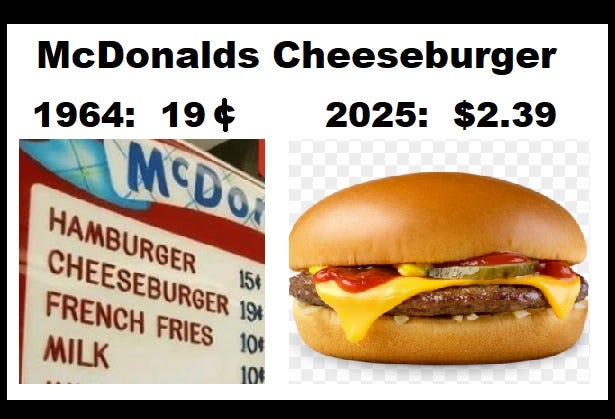

In constant silver terms, the minimum wage has dropped from 5 silver quarters per hour in 1964, to a little more than 1 silver quarter per hour in 2025. Note the price of a gallon of gas or a cheeseburger in 1964.

In 1964, a cheeseburger cost 15% of the hourly minimum wage. IOW, a low-wage worker earned 6.6 cheeseburgers per hour for his labor.

In 2025, a cheeseburger costs 33% of the hourly minimum wage. IOW, a low-wage worker earns 3 cheeseburgers per hour for his labor.

It's no wonder that young Americans can't afford to buy an entry-level home. The American dollar has been debased and the American worker has been impoverished. [And by the way, that photo of a basic 2025 McDonald's cheeseburger is an over-inflated joke. Today they are the size of a hockey puck.]

In 1964, one silver quarter, or 1/5 of the hourly minimum wage, would buy almost a gallon of gasoline. One hour of minimum wage labor would put 4.5 gallons of gas in a car's fuel tank at 28 cents/gallon.

According to Grok, in July 2025 the American average price per gallon for 87 octane unleaded is $3.17 per gallon. One hour of minimum wage labor will only put 2.3 gallons of gas in a worker's tank.

Meanwhile, in 2025, the silver melt value of that one single 1964 real silver quarter is $7, or almost the current minimum wage.

The real-world purchasing power of the American worker has been cut in half over the last sixty years. This is why young Americans feel so much resentment toward the Boomers, who were able to buy nice homes on an average salary. But please don't blame the Boomers for when they were born. The dollar was debased by our political elites, and the savings of Americans have been stolen through inflation. [Related Substack: Baby Boomers Better Beware: A geronticidal fury is building to the boiling point]

I just find it incredibly ironic, or maybe just coincidental, that our government (as it now seems) murdered JFK in 1963, commemorated him with millions of genuine-silver Kennedy half dollars in 1964, and then debased the dollar by switching from silver to silver-painted copper coins in 1965.

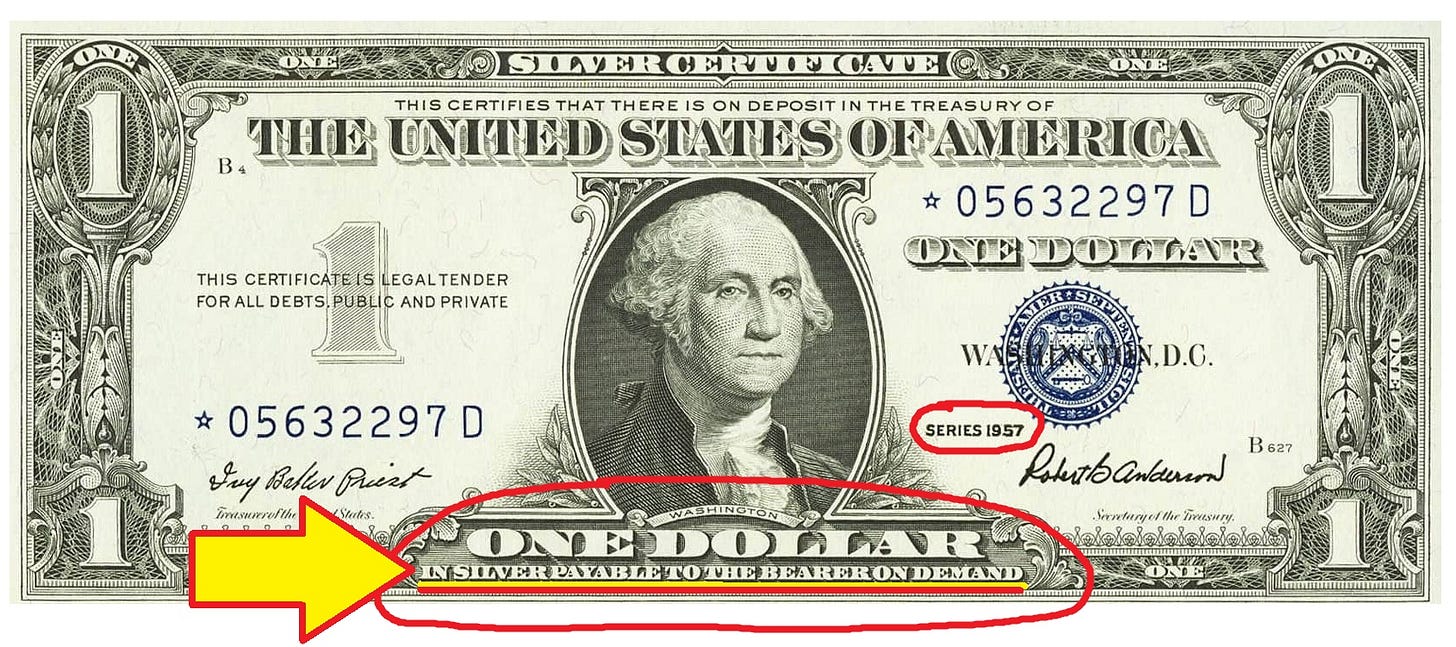

I asked Grok about "silver certificate" U.S. dollars, because I was unclear about their importance: "Silver certificates, U.S. paper currency backed by silver, were redeemable for silver from their introduction in 1878 until June 24, 1968. Initially authorized under the Bland-Allison Act, they allowed holders to exchange them for silver dollars or bullion at the U.S. Treasury. The redemption period continued through various legislative changes, but the U.S. government ended it in 1968 due to rising silver prices and the depletion of silver reserves. After this date, silver certificates remained legal tender but could no longer be exchanged for physical silver, marking the end of the U.S. dollar’s tie to the metal."

Below is what our old Silver Certificate dollar bills looked like. BTW, I was born in 1957, the year this dollar bill was printed.

“ONE DOLLAR IN SILVER PAYABLE TO THE BEARER ON DEMAND”

Investopedia has this to say:

https://investopedia.com/articles/markets-economy/090116/what-silver-certificate-dollar-bill-worth-today.asp "In 1963, the House of Representatives passed PL88-36, repealing the Silver Purchase Act and instructing on the retirement of $1 silver certificates. The act was predicated by a prospective shortage of silver bullion. Certificate holders could exchange the print for silver dollar coins for approximately 10 months. In March 1964, Secretary of the Treasury C. Douglas Dillon stopped the issuance of coins, and for the next four years, certificates were redeemable for silver granules. The redemption period for silver certificates ended in June 1968."

Today we are given “Federal Reserve Notes” which are paper coupons backed by exactly nothing but the “Full faith and credit of the United States Government.”

There is no restraint at all on the U.S. Government and the private Federal Reserve. They can and are creating trillions of new digital dollars out of thin air, inflating away the value of our life savings. Inflation is not an act of God, or of nature, or “just one of those things.” Inflation is theft. It’s a stealth tax on ordinary Americans.

Meanwhile, at the same time that our government is inflating away the value of our savings, our duly-elected mis-leaders from both parties have flooded America will untold millions of "legal" and illegal immigrants from the 3rd world, further depressing the real wages of Americans.

These waves of immigrants are subsidized by the federal government in many ways, which drives up the cost of housing and puts home ownership beyond the reach of young Americans who trying to get on the ladder of success and family formation.

Here is the link to the Tucker Carlson video clip. It’s also written in transcription there, if you don’t want to watch the video.

To our mis-leaders in both parties, American citizens are only dumb tax cows and cannon fodder for their neocon wars. They killed JFK, and a year later they switched silver money for worthless paper Federal Reserve Notes. They did that so that they could rob us blind through inflation, all while funding endless wars and their pet projects, and we barely noticed.

And to add insult to injury, they have been importing tens of millions of compliant low-wage 3rd world serfs to replace us in our own homeland.

We are just the marks in a very long con.

Bracken Out.

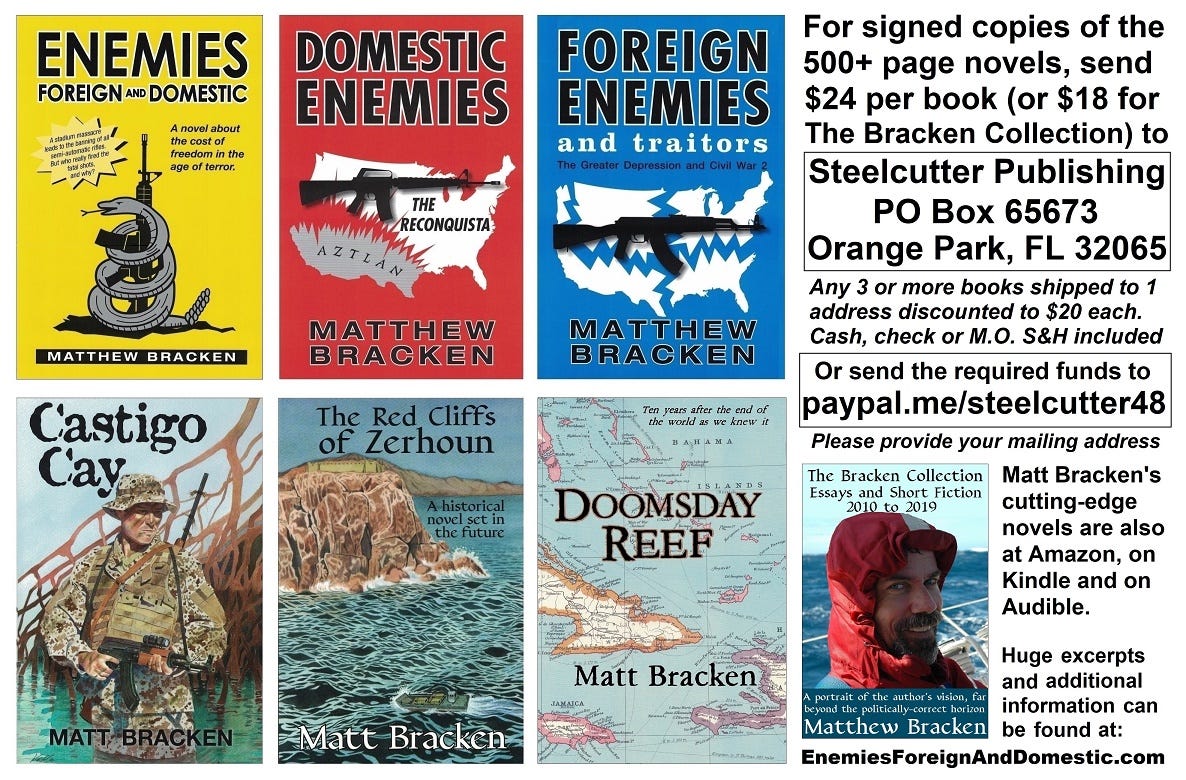

If you’d like to read my full-length novels, here is my Amazon author page link. You can get my novels from Amazon in print, Audible and Kindle formats.

Or, you can order the printed books directly from me, and I’ll sign them.

Snail mail works fine, but paypal.me/steelcutter48 is faster.

Funny how most people think of our so-called money being backed by the U.S. government. How is that even logical when they are called Federal Reserve Notes and the Fed actually has nothing to do with the government. When they were silver certificates and actually redeemable for silver ( real money) through the government, it was a total different story. Getting rid of Silver Certificates and the Gold Standard, gave the bankers their final control.

Also on selling junk silver below spot, it is all going to depend on the actual silver weight of the junk silver. Spot price is per ounce of 99% silver bullion ( rounds, bars, etc.). Hence at $38 ounce an ounce of 99% silver bullion. an ounce of 90% silver (junk) would be 10% less or 3.80 less. So a dealer could technically say he's selling an ounce of junk silver below spot. Not sure if they do it that way as I lean more towards bullion. Just sayin'.

Linked Jesse's article last week. will be linking yours today @https://nothingnewunderthesun2016.com/

Thanks for this article. Day to day price movements aside, there are real reasons to think about owning some silver and they are laid out convincingly in the drama of Matt Bracken's excellent novel, "Doomsday Reef."